Are EU immigrants a fiscal plus or a minus for their host countries?

March 21, 2017

by Rafael Ahlskog

The right to free movement is one of the fundamental pillars of the European project. As of 2015, nearly 13 million EU citizens were living in a member state other than their country of birth. This right also includes the right to work and in large part to partake of the public services offered in one’s new country. The large-scale movements within the European Union seen in the last 15 years have naturally spurred a number of political discussions regarding the sustainability and distributional consequences of free movement. In particular, claims are often made about how migration between EU countries affects the public finances of the receiving country.

Despite the salience of such questions in an increasingly interconnected Europe, only limited research has been done to provide answers. A part of the REMINDER project has been dedicated to making the first large, comparative set of estimates of the fiscal effects of the migration of EU citizens within the European Economic Area (EEA). Synthesizing a number of data sources and using a unique method, we have been able to produce estimates for 29 out of the 31 countries in the EEA spanning the years 2004-2015.

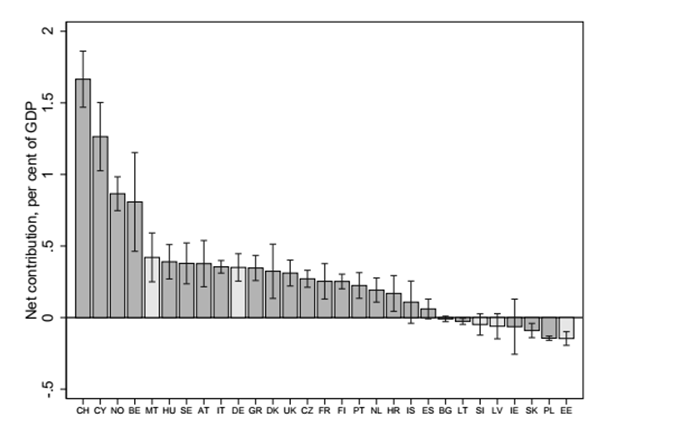

The results are neither surprising nor dramatic. The net fiscal effects are generally positive, but fairly modest. In most countries we find that the fiscal effects are in the narrow range of +-0.4% of GDP. A net contribution of 0.4% of GDP can be compared to the revenue generated by a change in the average income tax rate of roughly one percentage point. In the region as a whole, the effect was positive during the period studied, despite the Great Recession taking a bit of a toll. The biggest winners are Switzerland, Cyprus, Norway and Belgium, for the simple reason that EU immigrant households on average provide a surplus, and these countries have the largest population shares of EU immigrants.

As any large-scale estimates of this sort, a number of simplifying assumptions had to be made. For example, we have assumed that EU migrants consume neither more nor less healthcare resources than nationals of the same age. Since it’s plausible that EU immigrants in fact consume less healthcare than nationals (and instead get some of their healthcare needs covered in their home country), this assumption would mean that the real effects might be slightly more positive than we find. On the other hand, we also assume that EU immigrants save and consume roughly the same proportion of their income in the host country and therefore pay roughly the same amount of VAT for a given income. Since it is also plausible that EU immigrants either save slightly more, or spend some of their income in their home country (perhaps via remittances), this would instead mean that the real fiscal effect is a little more negative than we find. All in all however, even large deviations from these assumptions don’t affect the general picture very much.

It is also important to keep in mind that these numbers are based on immigration specifically, and do not represent the full picture of the consequences of free movement. If we want the full picture of free movement, we would also have to include emigration effects; that is, the effects on the public budget of having someone leave. Furthermore, consequences of migration not only affect the public budget but the economy as a whole: these effects are not visible in the estimates we’ve produced here.

You can read the working paper here.

About the author

Rafael Ahlskog is a Researcher at the Department of Government at the University of Uppsala, working on work package 4 of the Reminder project.