The Effects of Immigration on Welfare Across the EU: Do Subjective Evaluations Align with Estimations?

January 4, 2019

By Scott Blinder and Yvonni Markaki

Research on attitudes toward immigration has long been characterised by a debate over whether economics or symbolic politics is the leading driver of public opinion. Economically-oriented scholars have argued that anti-immigration sentiment stems from “realistic” notions of group competition. Residents of immigrant-receiving countries may want to limit new arrivals in order to preserve their own access to jobs and other valued resources (Blalock 1967; Blumer 1958). On the other hand, scholarship rooted in social and political psychology has argued that anti-immigration sentiment stems from prejudice or aversion to cultural difference or change (Valentino et al. 2017). Although debate continues, scholars have struggled to find evidence for the economic argument. Their focus on labor market competition between migrants and so-called “native” workers has been called a “zombie theory” – one that will not go away despite lack of evidence (Hainmueller and Hopkins 2014; Jeannet 2018).

However, the economic impact of immigration – whether real or perceived – may affect attitudes in other ways. In particular, a great deal of negative discourse around immigration focuses on migrants’ access to and use of welfare state benefits. Anti-immigration rhetoric alleges that access to state benefits, such as health care, unemployment insurance, or housing assistance, acts as a “pull factor,” increasing immigration.

Crude versions of this discourse are easily debunked by studies showing that migrants tend to be employed at high rates, and therefore contribute at least as much as they take away from the public balance sheet. But it might still be true that anti-immigration attitudes are linked to either perceived or real fiscal impacts.

Our recent research addresses these questions by examining the determinants of citizens’ perceptions of impact of immigration on public finances. Are concerns about intra-EU mobility really a result of misunderstanding about how immigrants affect the welfare and public finances of receiving countries? Is there any link between economic realities and perceptions? If so, we would expect that immigrants’ actual net contributions to the fiscal balance sheet in their country of residence would have some influence on the perceptions of those contributions by residents of the host country.

The fiscal burden hypothesis argues just that: namely, that negative reactions to immigration stem from the actual ways in which immigration impacts public finances. Our research tests this hypothesis, and explores multiple mechanisms through which it might work. We assess the extent to which having been born in the country (identity considerations), or having sufficiently contributed towards costs (economic considerations), acts as the primary determinant of a person’s evaluation of the fiscal impact of immigration.

Until recently, there was no clear evidence available on either the fiscal impacts of immigrants—especially when distinguishing intra-EU mobility from non-EU immigration—or the perceptions of those impacts among EU nationals. We explore this relationship by bringing together cross-national surveys and the latest country-level estimates of fiscal effects produced within the REMINDER project. Our analysis is the first of its kind to directly compare evaluations of welfare effects with econometric estimates, and to extend the comparison to nearly all countries in the EEA (28 countries) over several years (2002/2008/2012/2014).

To identify people’s perceptions, we utilize survey questions that ask respondents to rank between 1 and 10 their view on whether immigrants on balance take out more in social support or contribute more in taxes (1, ‘take out more’ – 10, ‘contribute more’). We use two alternative indicators of welfare effects across countries and years, which we label fiscal exposure from immigration. The first indicator reflects how much, on average, immigrants receive in benefits relative to what they contribute in social security contributions and income taxes (economic fiscal exposure). The second measures how many immigrants benefit from receiving-country welfare state payments relative to the native population (demographic fiscal exposure). For each of these we account for fiscal exposure from intra-EU versus non-EU immigration separately.

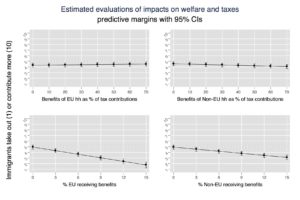

Figure 1 displays how respondents’ subjective evaluations are predicted to vary depending on the level of fiscal exposure from immigration; each sub-figure represents a respective indicator. If perceptions of fiscal burdens reflect economic realities of those burdens, then at a minimum, we should find that EU citizens view immigrants’ impacts on public finances more positively if they live in countries where immigrants’ contributions are higher, and less positively in countries where contributions are lower.

Figure 1

Notes: Sample of ~130,000 EU nationals across 28 countries and four survey years (ESS1/ ESS4/ESS7/EQLS3); Results based on fixed portion of linear mixed effects model; Graphs plot the respondents’ position on the evaluation scale (vertical axis) as predicted for different levels of fiscal exposure from immigration (horizontal axis)

As can be seen in the top left and right subgraphs, evaluations are no different between people who live in countries with higher or lower economic fiscal exposure (both EU and non-EU). In simplified terms, immigrants are just as likely to be viewed as net contributors in countries where they take out more as they are in countries where they take out less. These results cast doubt on the hypothesis that economic realities shape perceptions.

However, the demographic indicator of fiscal exposure suggests a more indirect association between realities and perceptions. Citizens are more likely to think that immigrants take out more than they contribute in countries where more EU immigrants receive benefits relative to the native population. The association is similar but less pronounced when it comes to non-EU related demographic fiscal exposure (bottom right sub-figure).

Our results show that EU citizens’ evaluations of the impacts of immigration on welfare are partly responsive to estimates of fiscal exposure from immigration in their country. However, evaluations depend less on the extent of immigrants’ contributions towards the costs of what they receive, and more on the identity of who is receiving. In this regard, our findings signal only a moderate explanatory potential for the fiscal burden theory, as identity considerations appear to underlie people’s perceptions of impacts more than economic considerations. Moreover, our results suggest that any explanatory power of the fiscal burden hypothesis will be inseparable from more identity-based perspectives such as group threat theory and welfare chauvinism.

We also find that perceived burdens respond similarly to fiscal exposure from intra-EU and non-EU immigration, providing further evidence that citizens’ views do not make particular exceptions for intra-EU immigrants.

You can read the working paper here.

About the authors

Scott Blinder is leading the REMINDER work package focusing on the drivers of opinions and norms. He is Assistant Professor of Political Science at UMass Amherst and previously served as Director of the Migration Observatory. He is a political scientist specialising in media coverage of and public opinion toward migration, and their impacts on elections and policy.

Yvonni Markaki is a researcher on the REMINDER project. She specialises in the politics and economics of immigration in Europe and in cross-national comparisons of public attitudes. She previously worked with the Oxford Migration Observatory as a research officer and also assisted the Global Exchange on Migration & Diversity programme.